RBI’s UDGAM Portal: Your Gateway to Reclaim Unclaimed Deposits

Table of Contents

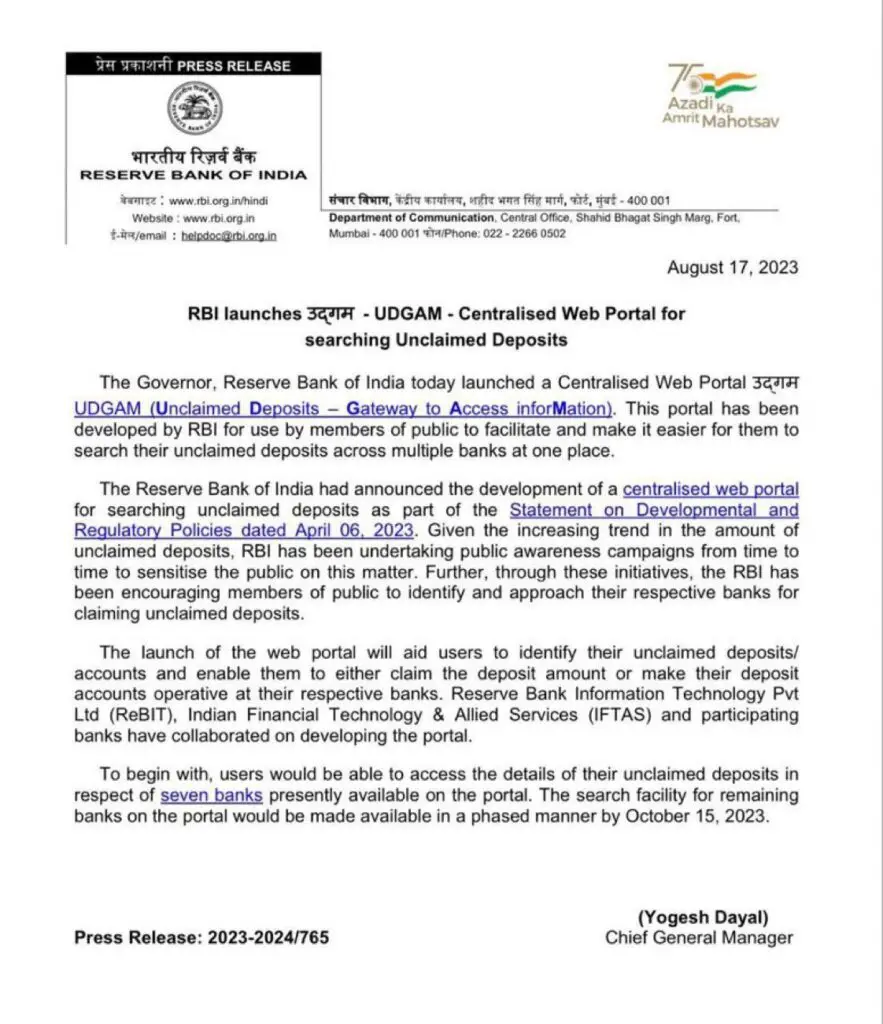

The Reserve Bank of India (RBI) has taken a customer-centric stride with the launch of the UDGAM portal on August 17, 2023. Named aptly as ‘Unclaimed Deposits – Gateway to Access Information’, this centralized web platform has been introduced to simplify the hunt for unclaimed deposits. Unveiling convenience for consumers, the portal empowers them to explore forgotten deposits across multiple banks from a single source.

The RBI’s motivation behind UDGAM stems from the need to enhance and broaden access to data concerning unclaimed deposits. Conventionally, banks publish lists of such dormant deposits on their websites. However, UDGAM elevates this endeavor by establishing an online hub that not only compiles this scattered information but also employs user inputs to search for potential unclaimed deposits across different banks.

Procedure for claim unclaimed deposite in UGDAM portal:

- Go to the UDGAM portal: Visit the website https://udgam.rbi.org.in/unclaimed-deposits/#/login.

- Log in: Enter your phone number, password, and the captcha code. Once done, input the OTP received on your phone.

- Provide details: On the next page, you must fill in the Name of the Account Holder (this is mandatory). Also, choose your bank from the list provided.

- Enter necessary information: Complete at least one input from the required fields and proceed accordingly.

The initiative was set in motion as part of the Statement on Developmental and Regulatory Policies disclosed on April 6, 2023, where the RBI pledged to create a centralized web facility to track unclaimed deposits.

The purpose of the UDGAM portal is to empower customers with a seamless approach to locating their unused deposit accounts. Through this resource, individuals can either reactivate dormant accounts within their respective banks or retrieve unutilized deposit amounts. Notably, this initiative is a collaborative effort involving the Reserve Bank Information Technology Pvt. Ltd. (REBIT) and the Indian Institute of Financial Technology and Allied Services (IFTAS).

Unclaimed deposit refer to following banks:

Currently, the portal presents information about unclaimed deposits held by seven banks, including prominent names like State Bank of India, Punjab National Bank, and DBS Bank India Limited. The remaining banks are expected to join the portal by October 15, 2023, further expanding its utility.

Unclaimed deposits refer to funds that have remained untouched for a decade in savings or current accounts, or in the case of fixed deposits, haven’t been claimed within a decade after their maturity date. With the UDGAM portal, RBI aims to bridge the gap between customers and their dormant funds, embodying financial inclusivity and ease of access.”

Certainly, here’s a human-friendly explanation of the mentioned section and its provisions of using UDGAM:

Have you ever wondered what happens to money left untouched in your bank account for a long time? In India, there’s a rule that addresses this situation. According to a specific section, if money has been sitting in an Indian bank account without any activity for a decade or more, or if there’s a deposit or some money that has been unclaimed for over ten years, there’s a procedure that comes into play.

When this ten-year mark passes, the money must be credited to a special fund within three months. This fund is designed to ensure that unclaimed money finds its way to a safe place, rather than staying idle in bank accounts

To read & Know more visit Gov site :https://udgam.rbi.org.in/unclaimed-deposits/#/login

To read more about other our blog:https://spotnews2023.com/index.php/2023/08/10/rbi-mpc-good-news-the-burden-of-loan-and-emi-will-not-increase-repo-rate-remained-stable-for-the-third-time-shaktikanta-das-announced/